Maintaining a focused investment approach

A structured investment strategy has been adopted and implemented to ensure all our investments are aligned with the Fund objectives. Central to this investment strategy is to identify and invest in standout start-up companies that have a strong potential to deliver change together with scalable business models to deliver financial returns.

We have also put in place an experienced and equiped Investment Committee, augmented by independent industry professionals, to oversee and manage our investment decisions.

Impactful

Delivering solutions which contribute to positive environmental or social change.

STRONG FOUNDERS

Strong and ambitious founders who are committed to achieve their company objectives and work collaboratively with the Fund and its support network.

EARLY STAGE

Initial investment at pre-seed, seed or late seed stage with the possibility to follow subsequent investment rounds where appropriate.

Product-Market Fit

At the product market fit stage with an established go to market offering.

SCALABLE MODEL

Operating on a B2B model with the possibility to sustainably scale annual recurrent revenue.

IP Ownership

Incorporate technology into their product offerings with definable Intellectual Property ownership.

Able to scale and expand to support domestic and international markets.

SDG Aligned

Strong alignment with relevant UN Sustainable Development Goals (SDGs).

RISK AND RETurn

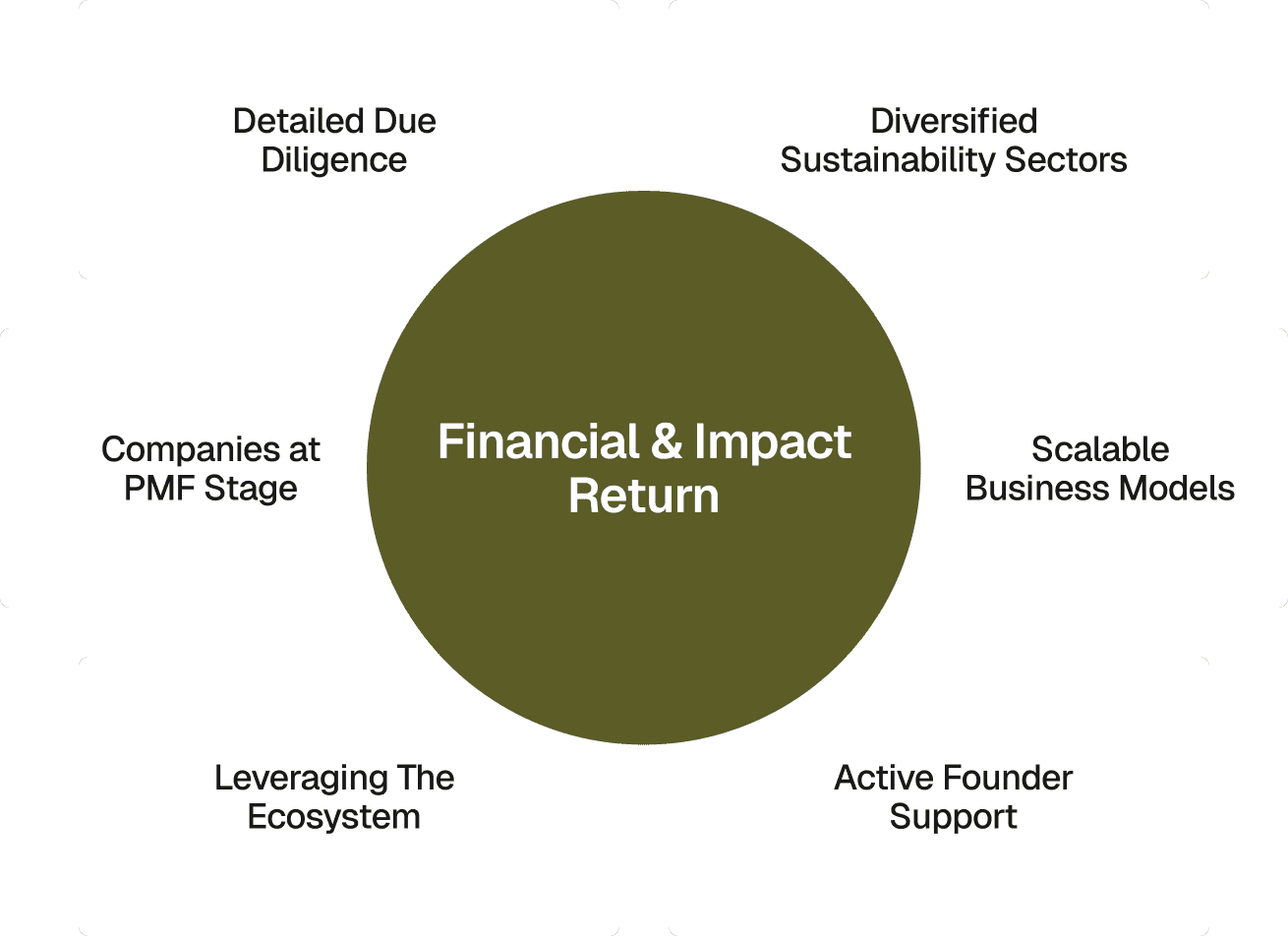

Managing risk, impact and return within the Fund

A number of initiatives are employed to manage risk, return and impact objectives across the Fund portfolio. By investing in multiple for-profit companies spanning diverse sustainability sectors, the Fund targets to achieve a wider breadth and depth of positive change while diversifying risk and generating financial returns for investors. Our approach recognises that sustainable impact requires sustainable business models. The fund is targeting to invest into a maximum of ten portfolio companies to maintain the focus and support to our founders necessary for their success